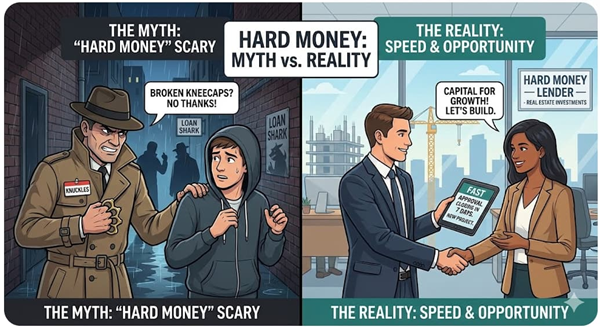

The real estate industry involves different types of projects, from construction to renovation. As most projects are a costly affair, financing is the best option. However, banks are traditional financial institutions that have imposed stringent rules for lending. So, hard money (private money lending) is the right choice for property owners who need instant cash.

Banks move slowly when they receive a loan application. If they find you ineligible, they will say NO to your appeal. To avoid this situation, apply for a private money loan.

AI-powered lending- A time-saving approach

Traditional banks focus on your full credit history, debt ratios, and tax returns. They even reject the application if you have chosen a low-income property as your security.

The AI-driven platforms for private money check your property’s basics and future potential. They also analyze the local trends and present a number of lenders in your locality. This is how the loan approval process becomes easy. You will also be able to compare loan interest rates set by different lenders.

So, you do not need to wait for bank approval when you want quick cash for your home improvement projects. The private money loan is not just for renovation or remodeling projects.

If you run a house flipping business, you may apply for this loan. Besides, commercial and investment property buyers can contact hard money loan providers to obtain the loan.

Lending process and eligibility criteria

The property you will buy is chosen as the security for the private money loan. In case you fail to repay, the lender will repossess your property. Although lenders have set their unique terms, a short repayment period is common. You should also make a large down payment.

Many private lenders for hard money do not check your credit score. It is one of the advantages of applying for a private money loan.

Conclusion

Property owners and investors who need a faster financing solution choose the private money loan providers. They can use the AI-driven online interface to search for the most reliable lender. It will help them save precious time.