In today’s fast-paced financial world, having a Trading account and understanding how to use it effectively can make a significant difference in your investment outcomes. Additionally, knowing when you have demat account is crucial for securely holding your investments. Here are some essential tips to help you maximize your profits using your Trading account and Demat account.

Stay Informed and Updated

To maximize your profits, it’s vital to stay informed about the latest market trends and news. Your Trading account offers real-time updates and insights that can help you make informed decisions. When have demat account, you gain access to various tools and resources that keep you updated with market developments. Regularly check your Trading account for the latest stock prices, economic indicators, and market news. This will help you identify potential opportunities and make timely decisions to maximize your returns.

Diversify Your Investments

Diversification is key to minimizing risk and maximizing returns. When you have demat account, you can invest in a wide range of assets, including stocks, bonds, mutual funds, and ETFs. Use your Trading account to explore these different investment options and build a diversified portfolio. By spreading your investments across various asset classes and sectors, you reduce the risk of significant losses and increase the potential for stable returns. Regularly review your portfolio through your Trading account to ensure it remains balanced and aligned with your financial goals.

Set Clear Investment Goals

Setting clear and realistic investment goals is crucial for long-term success. When you get one demat account, you should have a clear idea of what you want to achieve. Use your Trading account to track the performance of your investments and set achievable targets for your portfolio growth. Whether you aim for a certain percentage return or specific capital gains, having defined goals will guide your trading decisions. Regularly review and adjust these goals as needed using the analytical tools available in your Trading account.

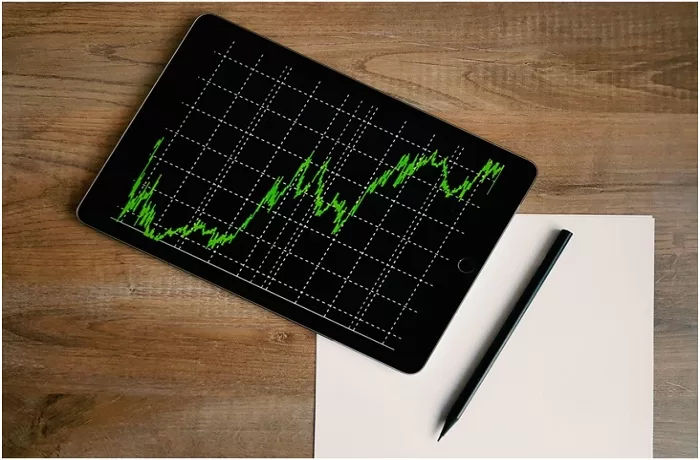

Utilize Analytical Tools

Modern Trading accounts come equipped with various analytical tools that can help you make informed decisions. When you open demat account, you gain access to features like technical analysis charts, stock screeners, and performance indicators. Use these tools to evaluate potential investments and identify profitable trading opportunities. By leveraging the analytical capabilities of your Trading account, you can enhance your decision-making process and maximize your profits.

Practice Effective Risk Management

Effective risk management is essential for protecting your investments. A demat account ensures you understand the risk associated with each investment. Use your Trading account to set stop-loss orders and price alerts for your securities. This helps you limit potential losses and protect your profits during volatile market conditions. Additionally, avoid over-leveraging and make sure your investment strategy aligns with your risk tolerance. Regularly monitor your risk exposure using your Trading account to maintain a balanced and secure portfolio.

Maintain Discipline

Discipline is key to successful trading. Stick to your investment strategy and avoid making impulsive decisions based on short-term market fluctuations. Use your Trading account to set reminders and alerts for important trading activities, such as rebalancing your portfolio or reviewing quarterly earnings reports. Staying disciplined and following a structured approach will help you make consistent and rational decisions, ultimately maximizing your profits.